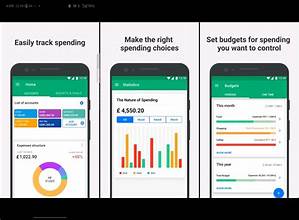

Best Apps to Track Your Expenses and Save Money Easily

Discover the best apps to track your expenses and save money easily. Simple and effective tools to manage your budget and grow your savings.

Managing money can be challenging, especially if you don’t know where your money goes. Luckily, technology makes it easy. Expense tracking apps help you save money, manage your budget, and reach financial goals faster.

In this article, you will learn the best apps to track your expenses and save money easily, explained in simple English.

Why Track Expenses?

- Helps control spending

- Reveals unnecessary expenses

- Increases savings

- Reduces financial stress

Tracking is the first step to financial discipline.

1. Mint

Mint is one of the most popular budgeting apps.

Features

- Tracks all your accounts in one place

- Categorizes expenses automatically

- Sends alerts for bills and overspending

- Helps set budgets and savings goals

Benefits

- Free to use

- Easy for beginners

- Helps save money without extra effort

2. YNAB (You Need A Budget)

YNAB focuses on proactive budgeting.

Features

- Assigns every dollar a job

- Helps plan expenses before spending

- Syncs with your bank accounts

- Provides financial reports

Benefits

- Encourages smart spending

- Helps build long-term savings habits

- Monthly subscription ensures continuous support

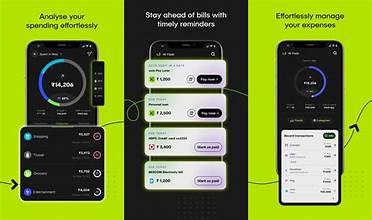

3. PocketGuard

PocketGuard helps control spending effectively.

Features

- Tracks income and expenses

- Shows how much you can safely spend

- Identifies recurring bills and subscriptions

- Categorizes expenses automatically

Benefits

- Simple and beginner-friendly

- Helps avoid overspending

- Free and premium options available

4. Goodbudget

Goodbudget uses the envelope budgeting method.

Features

- Assign money to different categories (envelopes)

- Track spending in each category

- Syncs across multiple devices

Benefits

- Easy to understand for beginners

- Helps save for goals

- Encourages disciplined budgeting

5. Personal Capital

Personal Capital is a mix of budgeting and investment tracking.

Features

- Tracks spending and income

- Provides investment insights

- Shows net worth and financial health

- Alerts for unusual spending

Benefits

- Good for saving and investing

- Free version offers many useful tools

- Helps plan for future financial goals

6. Wally

Wally is simple and intuitive for daily tracking.

Features

- Record income and expenses quickly

- Track savings goals

- Scan receipts for easier tracking

- Supports multiple currencies

Benefits

- Free and easy to use

- Great for beginners and travelers

- Helps save money by tracking spending

7. EveryDollar

EveryDollar is simple budgeting app by Dave Ramsey.

Features

- Zero-based budgeting approach

- Track every dollar of income

- Monthly budgeting and expense tracking

- Connect bank for automatic updates

Benefits

- Helps build saving habits

- Simple interface

- Beginner-friendly

Tips for Using Expense Tracking Apps

- Update your expenses daily

- Review weekly or monthly

- Set realistic budgets

- Track savings goals

Regular tracking makes saving easier and consistent.

Common Mistakes to Avoid

- Ignoring small daily expenses

- Not reviewing reports

- Setting unrealistic budgets

- Forgetting to sync accounts

Avoiding these mistakes ensures better results.

How Much Can You Save?

- Beginners: $50–$200 per month by tracking small expenses

- Consistent users: $500+ per month over time

Even small changes in spending habits grow into significant savings.

Who Can Use These Apps?

- Students

- Working professionals

- Stay-at-home parents

- Anyone who wants better financial control

Expense tracking apps are suitable for everyone.

Final Conclusion

Using apps to track expenses is a smart and easy way to save money and manage your budget. Apps like Mint, YNAB, PocketGuard, and Goodbudget help beginners stay organized and make better financial decisions.

Start using one of these apps today and watch your savings grow without stress.